Tax Service Bills Explained in Under 3 Minutes: Why Beautiful Billing Matters More Than You Think

- smithtaxesandmore

- Dec 22, 2025

- 5 min read

You've probably seen them before: those confusing, cluttered tax service bills that leave you scratching your head. One line says "professional services," another mentions "additional fees," and somewhere buried in the fine print are tax calculations that make zero sense. Sound familiar?

Here's the thing: your tax service bill isn't just a piece of paper asking for money. It's a reflection of your accountant's professionalism, a legal document for your records, and: when done right: a powerful tool that builds trust and eliminates confusion.

Let's break down what makes a tax service bill truly "beautiful" and why it matters more than you might think.

What Exactly Is a Tax Service Bill?

A tax service bill is a formal document issued by tax professionals detailing the specific services provided, charges applied, and applicable taxes. Unlike a simple receipt from your local coffee shop, these bills carry weight for both your business records and tax compliance.

Think of it as your financial paper trail. When the IRS comes knocking (and they sometimes do), a well-documented tax service bill can be the difference between a smooth audit and a paperwork nightmare.

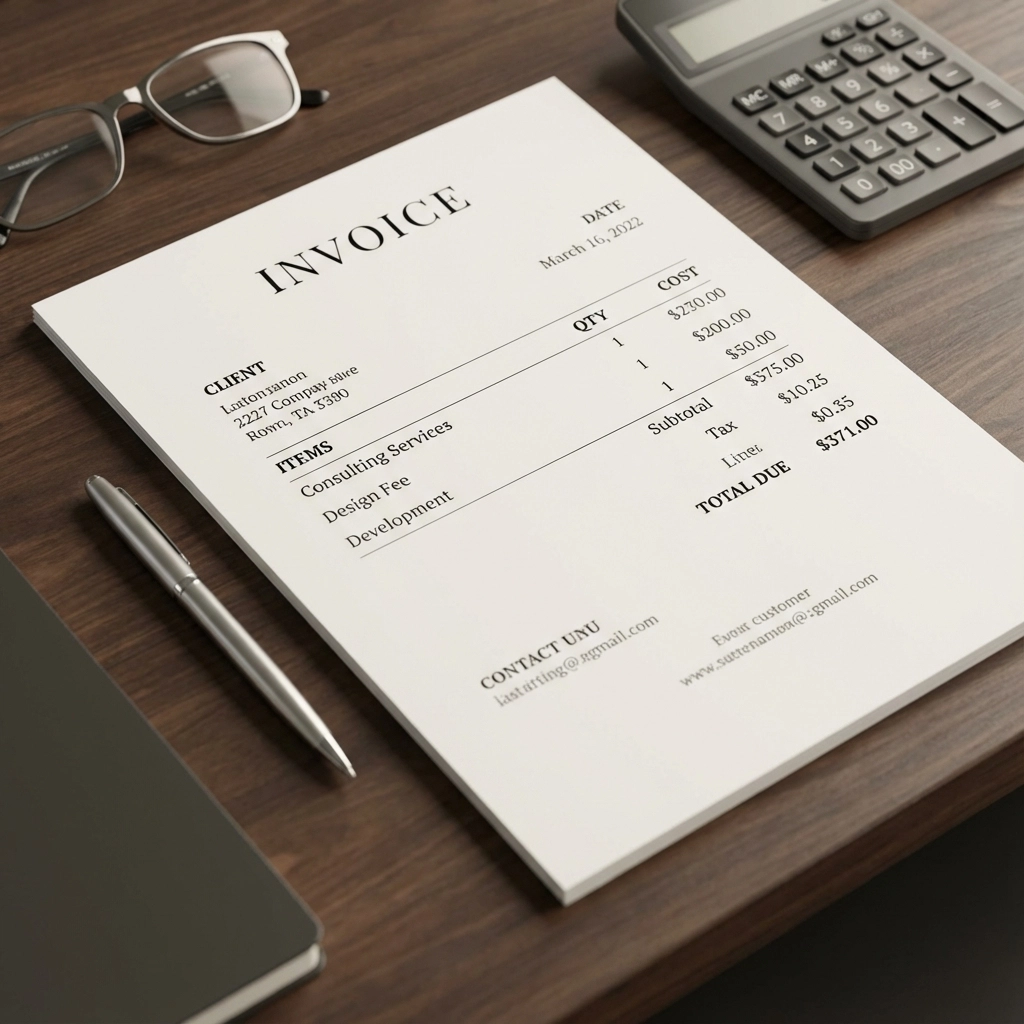

The Anatomy of a Professional Tax Service Bill

Service Breakdown That Actually Makes Sense

Your bill should read like a story, not a mystery novel. Each service should be listed separately with clear descriptions:

"Individual Tax Return Preparation (Form 1040)" instead of "Tax Prep"

"Quarterly Bookkeeping Services (Jan-Mar 2025)" rather than "Bookkeeping"

"Business Tax Planning Consultation (2 hours)" not just "Consultation"

This level of detail isn't just nice to have: it's essential for your records and helps you understand exactly what value you're receiving.

The Money Trail

Professional billing requires crystal-clear financial breakdowns:

Subtotal before taxes: What you're paying for services

Tax rate and amount: Usually your local sales tax rate applied to services

Final total: The actual amount due

Each component should be clearly labeled and easy to find. No one should need a magnifying glass to figure out their tax liability.

Business and Client Information

Every legitimate tax service bill includes:

Your accountant's business name, address, and tax ID number

Your information as the client

A unique invoice number for tracking

Issue date and payment terms

Contact information for questions

Missing any of these elements? That's a red flag.

Why "Beautiful Billing" Builds Better Business Relationships

Trust Through Transparency

When clients receive clear, detailed bills, they immediately understand what they're paying for. This transparency builds trust faster than any marketing campaign ever could. Compare these two scenarios:

Scenario A: "Professional Services: $850" Scenario B: "Individual Tax Return Prep: $300, Business Quarterly Review: $400, Tax Planning Session: $150"

Which one would make you feel more confident about your investment?

Eliminating Payment Disputes

Confused clients ask questions. Lots of them. And questions turn into disputes, which turn into delayed payments and damaged relationships. Clear billing cuts through this chaos by answering questions before they're asked.

When everything is itemized and explained, clients rarely challenge charges because they can see the direct value they received.

Professional Image Enhancement

Your bill is often the last impression you make on a client during each service cycle. A sloppy, confusing bill suggests sloppy work. A clean, professional bill reinforces the quality of your services and encourages referrals.

Common Billing Mistakes That Cost You Money

The "Bundling" Trap

Many tax services lump everything together: "Tax Services: $1,200." This approach might seem simpler, but it actually creates problems:

Clients can't verify they received everything they paid for

You can't easily track which services are most profitable

Future pricing becomes difficult to justify

Missing Tax Components

Here's where things get legally important. If you're charging sales tax on your services (which varies by state), that tax must be clearly separated and identified on your bill. Burying it in the total amount can create compliance issues and confuse clients who need those details for their own tax records.

Vague Payment Terms

"Payment due upon receipt" isn't specific enough. Professional billing includes:

Exact due date (e.g., "Payment due January 15, 2026")

Late payment fees if applicable

Accepted payment methods

Contact information for billing questions

The Business Benefits You Might Not Expect

Streamlined Year-End Processes

When your bills are consistently well-organized throughout the year, your own accounting becomes significantly easier. Tracking income, categorizing services, and preparing your business taxes happens faster when you have clear documentation.

Better Client Retention

Clients who understand their bills are clients who feel respected. This emotional connection translates directly into loyalty and repeat business. In the tax service industry, where relationships span decades, this matters enormously.

Reduced Administrative Time

Clear billing reduces follow-up calls, email exchanges about charges, and payment delays. Your staff spends less time explaining bills and more time on revenue-generating activities.

What This Means for You as a Client

If you're working with a tax professional, their billing practices tell you a lot about their overall approach to business:

Clear, detailed bills suggest attention to detail in tax preparation

Prompt, professional invoicing indicates good business systems

Transparent pricing reflects honest business practices

If your current tax service provider sends confusing bills, it might be time to evaluate your options.

The Technology Factor

Modern tax service billing has evolved beyond simple word processors. Professional firms now use specialized accounting software that automatically calculates taxes, tracks payments, and maintains client records. This technology enables the kind of detailed, accurate billing that benefits everyone involved.

However, technology is only as good as the people using it. The best billing systems still require human oversight to ensure accuracy and clarity.

Making the Switch to Beautiful Billing

Whether you're a business owner evaluating tax services or a tax professional looking to improve your practice, beautiful billing starts with a simple question: "Does this document clearly communicate value?"

If someone unfamiliar with your business could read the bill and understand exactly what services were provided and why they cost what they do, you're on the right track.

The Bottom Line

Beautiful billing isn't about fancy fonts or colorful logos: it's about respect, transparency, and professionalism. It's the difference between a transactional relationship and a trusted partnership.

In an industry built on trust and accuracy, your billing practices are a direct reflection of your values. When you prioritize clear, honest communication in your bills, you're setting the foundation for long-term business relationships that benefit everyone involved.

The next time you receive a tax service bill, take a moment to evaluate it. Does it answer your questions before you ask them? Can you clearly see the value you received? If not, it might be time for a conversation: either with your current provider about improving their billing practices, or with a new provider who already understands that beautiful billing matters.

Remember: in the world of tax services, clarity isn't just nice to have: it's absolutely essential for protecting both your financial records and your peace of mind.

Comments