Stop Wasting Time on Messy Financial Records: 5 Quick Bookkeeping Hacks That Save You Money

- smithtaxesandmore

- Nov 17, 2025

- 4 min read

Let's be honest, most small business owners would rather be doing literally anything else than sorting through receipts and reconciling bank statements. But here's the thing: messy financial records aren't just annoying. They're expensive. Really expensive.

Poor bookkeeping costs the average small business thousands of dollars annually through missed tax deductions, late payment fees, and hours of wasted time during tax season. The good news? You don't need to become an accounting wizard overnight. These five simple hacks will transform your financial chaos into a streamlined system that actually saves you money.

Hack #1: Set Up Automatic Bank Feeds and Transaction Rules

Remember the days of manually typing in every single transaction? Yeah, let's leave those in the past where they belong.

Modern accounting software like QuickBooks can automatically pull transactions from your bank accounts and credit cards. But here's where most people stop: and miss out on the real time-saver. You can create rules that automatically categorize recurring transactions.

For instance, set up a rule so that every charge from your office supply store automatically gets categorized as "Office Expenses." Monthly software subscriptions? Auto-categorize them as "Software & Technology." Your weekly fuel stops? "Vehicle Expenses."

The setup takes maybe 30 minutes upfront, but it saves hours every month. More importantly, it eliminates the human error that happens when you're rushing through transactions at 11 PM the night before your tax appointment.

Pro tip: Start with your most frequent vendors first. These usually represent 80% of your transactions anyway, so you'll see immediate results.

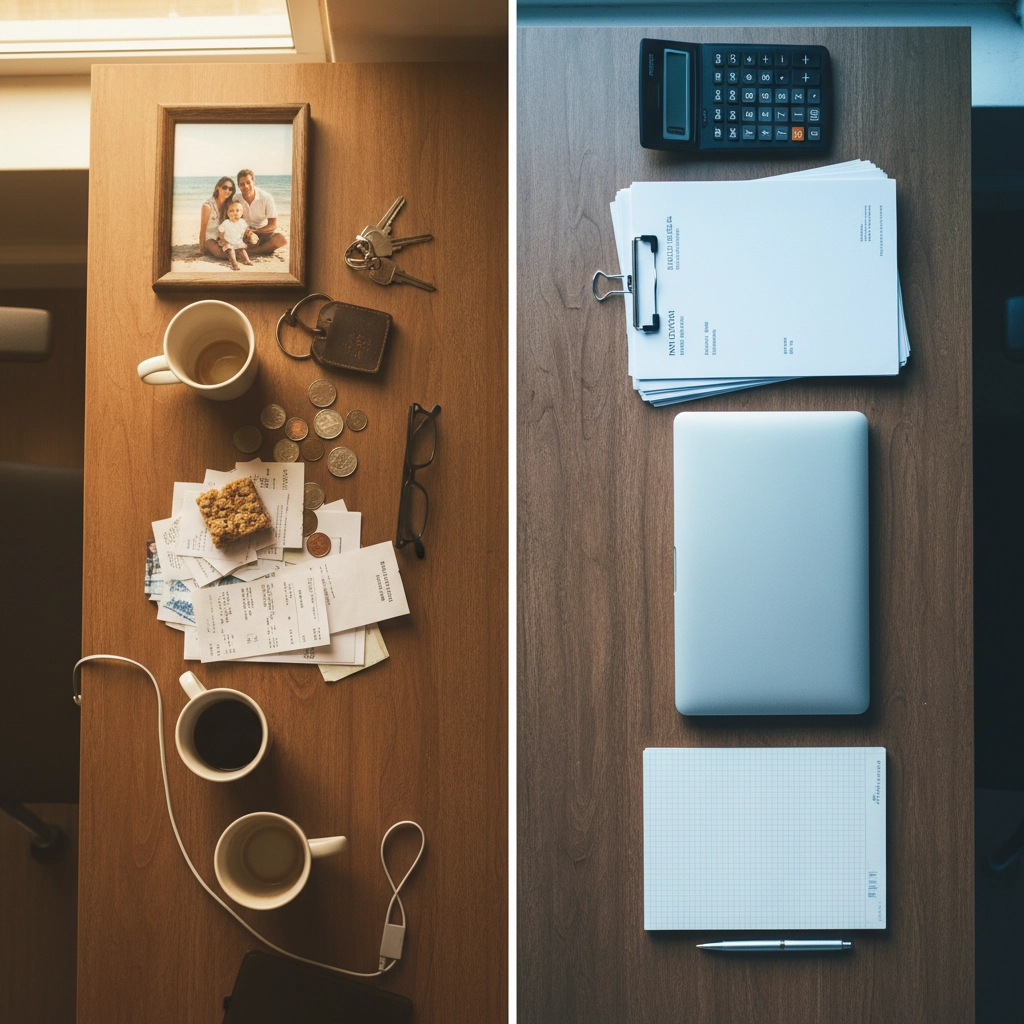

Hack #2: Separate Business and Personal Finances (No Exceptions)

This one sounds obvious, but you'd be amazed how many business owners are still using their personal checking account for business expenses "just this once."

Mixing personal and business transactions is like trying to untangle Christmas lights: frustrating, time-consuming, and usually ends with you wanting to throw everything in the trash.

When everything runs through separate accounts, your accounting software can automatically categorize most transactions correctly. Your bank statements become a clean record of business activity. And if the IRS ever comes knocking, you won't spend sleepless nights trying to explain why your business account shows charges for groceries and your kid's soccer fees.

The financial benefits go beyond organization. Many business banking accounts offer better expense tracking tools, business credit building opportunities, and specialized services that personal accounts don't provide.

Reality check: If you're currently mixing accounts, don't panic. Start using separate accounts going forward, and gradually sort out the mixed transactions during your regular bookkeeping sessions.

Hack #3: Digitize Receipts the Moment You Get Them

That shoebox full of crumpled receipts isn't a filing system: it's a tax deduction graveyard.

Paper receipts fade, get lost, or become illegible right when you need them most. Meanwhile, those lost receipts represent real money you can't deduct come tax time.

The solution is stupidly simple: snap a photo of every receipt immediately, then toss the paper. Most accounting apps have built-in receipt capture features that let you photograph receipts and match them to transactions automatically.

But here's the game-changing part: many apps can read the receipt text and automatically extract the vendor, amount, and date. No manual data entry required.

Some business owners take this a step further by setting up a simple email system. Take a photo, email it to a dedicated folder, and let your bookkeeper or accountant sort them during monthly cleanups. The key is building the habit of capturing receipts immediately, not collecting them for later sorting.

Money-saving reality: A single lost receipt for a $500 business expense could cost you $150+ in additional taxes (depending on your tax bracket). Multiply that by all the receipts you've probably lost, and this habit pays for itself quickly.

Hack #4: Use Recurring Transactions for Predictable Expenses

If you're manually entering the same rent payment, insurance premium, or software subscription every month, you're working harder than necessary.

Most accounting software allows you to set up recurring transactions for expenses that happen regularly. Set it up once, and the software automatically creates the transaction on schedule: weekly, monthly, quarterly, whatever you need.

This works especially well for:

Rent and utilities

Insurance payments

Software subscriptions

Loan payments

Regular contractor fees

The time savings add up quickly, but the real benefit is consistency. You'll never forget to record a payment, which means your financial reports are always accurate and up-to-date.

Advanced move: Set up recurring transactions for predictable income too, like retainer fees or subscription revenue. This gives you a clearer picture of your cash flow trends.

Hack #5: Create Smart Expense Categories From Day One

Here's where most people go wrong: they either use too few categories (everything goes to "General Expenses") or too many (separate categories for "Red pens" and "Blue pens").

The sweet spot is creating categories that match how you actually think about your business expenses. If you're a contractor, separate "Materials" from "Tools" from "Subcontractor costs." If you run a consulting business, distinguish between "Marketing" and "Professional development" and "Client entertainment."

Smart categorization serves two purposes: it makes tax preparation infinitely easier, and it gives you actual business insights. When you can see exactly how much you're spending on marketing versus operations, you can make better decisions about where to invest (or cut back).

The test: Your categories should let you answer questions like "How profitable was that Johnson project?" or "Are we spending too much on marketing this quarter?" without exporting data to Excel for analysis.

Start with broader categories and split them later if needed. It's easier to divide "Office Expenses" into "Supplies" and "Equipment" later than to merge 47 micro-categories into something useful.

The Bottom Line: Small Changes, Big Results

These aren't revolutionary concepts: they're simple systems that compound over time. The business owner who implements these five hacks will spend 75% less time on bookkeeping while maintaining significantly more accurate records.

More accurate records mean better tax deductions, fewer missed payments, clearer business insights, and zero panic attacks when tax season rolls around.

The best part? You don't need to implement all five hacks at once. Pick one, spend a weekend setting it up, then move to the next one next month. By this time next year, you'll have a bookkeeping system that actually works for you instead of against you.

If you're feeling overwhelmed by the setup process or need help getting your current records organized, our full-service accounting team can handle the heavy lifting while you focus on running your business. Sometimes the best hack is knowing when to delegate.

Comments