5 AI Tax Mistakes That Could Trigger an IRS Audit (And How Nationwide Professional Services Keep You Protected)

- smithtaxesandmore

- Dec 14, 2025

- 5 min read

The rise of AI-powered tax software promised to make filing easier than ever. But here's what nobody's talking about: these same tools are creating a perfect storm of audit triggers that could cost you thousands in penalties, interest, and professional fees down the road.

The IRS has been quietly ramping up their own AI detection systems, and they're getting scary good at spotting returns that show signs of artificial intelligence errors. While AI can crunch numbers fast, it lacks the critical thinking and nuanced understanding that tax law requires: and that gap is becoming a major liability for taxpayers who rely on it.

Let's dive into the five most dangerous AI tax mistakes that are putting businesses and individuals directly in the IRS crosshairs.

Mistake #1: AI Confidently Misinterprets Complex Tax Laws

Here's the biggest problem with AI tax tools: they don't actually understand tax law. Instead, they use pattern recognition to predict what "sounds right" based on their training data. When they get it wrong: which happens nearly 50% of the time for complex questions: they do it with complete confidence.

The danger isn't just that AI makes mistakes. It's that these tools provide no warning when they're steering you into audit territory. They'll confidently tell you that a business expense is deductible when it's actually a red flag, or incorrectly calculate depreciation schedules that don't align with current IRS guidelines.

Professional tax preparers, on the other hand, understand the nuances and gray areas that AI simply cannot navigate. They can spot situations where the tax code has exceptions, special rules, or recent changes that AI training data might not capture. This expertise becomes crucial when the IRS comes knocking with questions about why your return doesn't match their expectations.

Mistake #2: Misclassifying Income and Deductions Without Recognition

AI processes numbers without critical thinking. If an expense gets classified into the wrong category, the system won't catch the mistake: it just keeps moving forward with incorrect information.

This creates a particularly dangerous scenario because the IRS uses sophisticated AI systems to compare your return against thousands of others in your industry. If your deduction patterns look significantly different from similar businesses, your return gets flagged for additional scrutiny.

For example, if AI incorrectly categorizes office supplies as professional services, or misclassifies contractor payments as employee wages, these inconsistencies show up immediately in IRS pattern-matching algorithms. What should have been a straightforward return suddenly becomes an audit target.

Professional services provide the quality control that AI lacks. Experienced preparers review classifications to ensure they align with both tax law requirements and industry standards, reducing the risk of triggering automated audit flags.

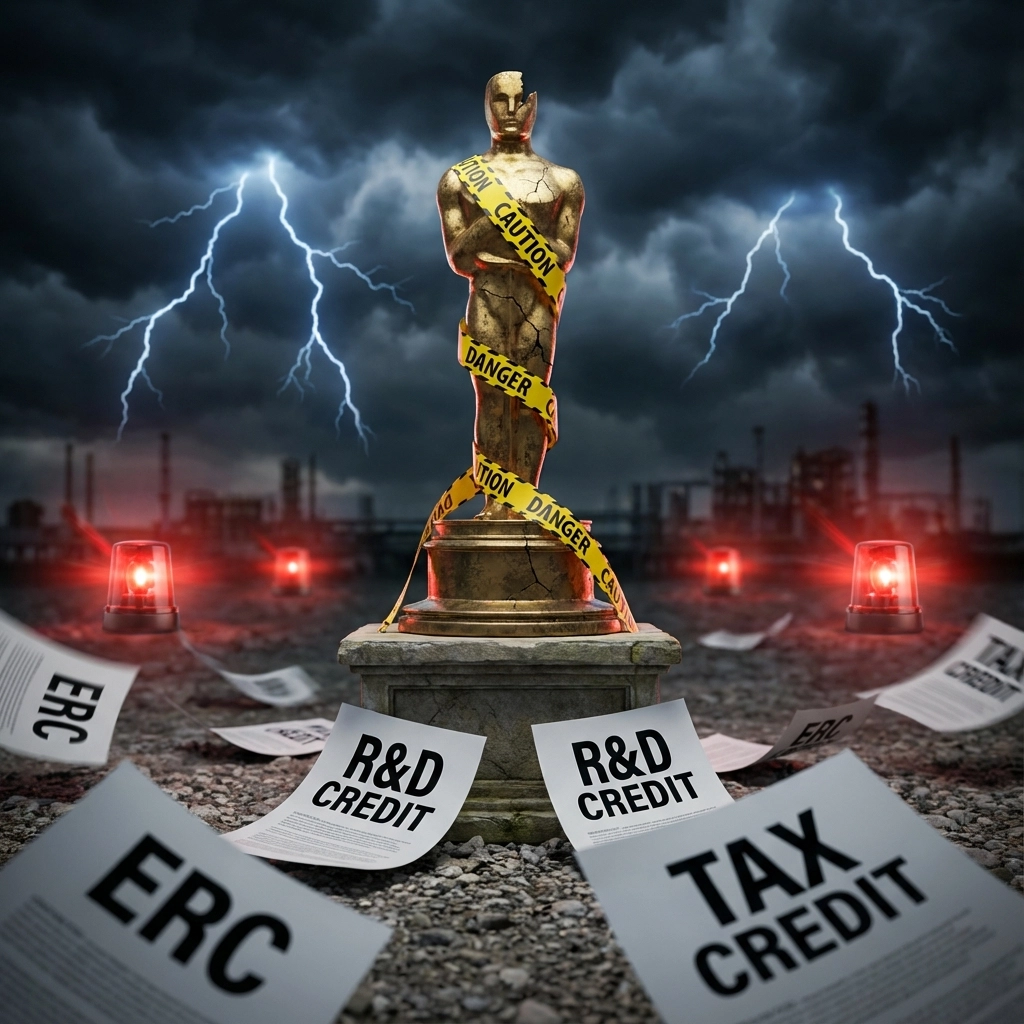

Mistake #3: Claiming Valuable Credits You Don't Actually Qualify For

This might be the most expensive AI mistake on our list. AI-powered tax prep services have been incorrectly telling business owners they qualify for valuable credits like the Employee Retention Credit (ERC), leading to waves of IRS audits and massive penalty assessments.

The same problem occurs with complex deductions like the R&D tax credit, home office deductions, and various business credits. AI doesn't understand the intricate eligibility requirements: it just sees keywords and dollar amounts that trigger its recommendation algorithms.

Here's what makes this particularly dangerous: these credits often involve substantial amounts of money. When the IRS determines you claimed a credit you didn't qualify for, you're not just paying back the credit: you're also facing penalties, interest, and potential fraud allegations.

Professional tax advisors understand the detailed requirements for each credit and deduction. They can properly evaluate whether you meet all the qualification criteria before claiming valuable credits that might otherwise trigger an audit.

Mistake #4: Accepting Outdated or Incorrect Information Without Verification

AI systems blindly accept whatever information you feed into them, whether it's accurate or not. If your payroll software imports the wrong income number, AI will accept it and build your entire return around incorrect data.

The IRS maintains sophisticated databases that track income reporting across multiple years. When your return shows income inconsistencies, missing forms, or numbers that don't reconcile with previous filings, automated systems immediately flag your return for review.

This problem gets worse when AI tools work with outdated tax law information. Tax codes change frequently, and AI systems may not reflect the most current regulations. What seemed like a legitimate deduction under last year's rules might now be a red flag under current law.

Professional preparers stay current with changing tax laws and provide the verification step that AI skips. They cross-reference your information against multiple sources and catch discrepancies before they become audit triggers.

Mistake #5: Missing Income Sources That the IRS Already Knows About

This is perhaps the most avoidable: yet common: AI mistake. AI tax software often misses income that should have been reported, particularly from side gigs, freelance work, rental income, investment gains, and cryptocurrency transactions.

Here's the critical issue: the IRS receives copies of all 1099s, W-2s, and other income reporting documents. Their AI systems automatically compare what taxpayers report against what they already know about. Any discrepancy: even small ones: immediately triggers automated audit flags.

Cryptocurrency transactions are particularly problematic for AI tools. The software often fails to properly categorize digital asset sales, mining income, or DeFi transactions, creating significant underreporting that the IRS can easily detect through blockchain analysis.

Professional services provide comprehensive income review that ensures all sources are properly reported and categorized according to current IRS requirements.

How Nationwide Professional Services Keep You Protected

While AI excels at basic data processing, it fundamentally lacks the critical thinking that tax preparation requires. Here's how professional services provide protection that AI simply cannot match:

Expert Legal Interpretation: Tax professionals understand the nuances of tax law that AI misses. They can correctly apply complex regulations and identify situations where special rules apply.

Quality Control and Verification: Unlike AI, professionals actively verify information and catch errors before filing. They review calculations, cross-check data sources, and ensure consistency across all forms.

Current Knowledge: Professional preparers stay updated with changing tax laws, court decisions, and IRS guidance that AI training data might not reflect.

Audit Protection: If your return does get selected for audit, professional representation can significantly reduce penalties and resolve issues efficiently.

At Smith Taxes & More, we've seen firsthand how AI mistakes are creating audit nightmares for taxpayers who thought they were saving money with automated solutions. Our nationwide virtual services provide the professional expertise you need without sacrificing convenience.

The bottom line: as the IRS becomes more sophisticated in detecting AI-generated errors, professional guidance isn't just valuable: it's becoming essential for protecting yourself from costly audit consequences that could have been easily avoided.

Comments